Equity Crowdfunding

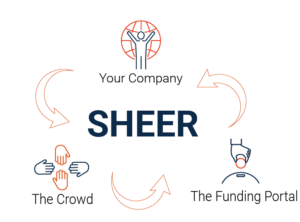

Sheer specializes in crowdfunding for equity and crowdfunding for rewards. Having followed the evolution and intricacies of crowdfunding laws and platforms, Sheer intimately understands how to be successful in this landscape.

Equity Crowdfunding Overview

Equity Crowdfunding has been a fundamental part of the JOBS Act since its announcement in 2012. During the early stages of Crowdfunding in the US, there was a limited amount of activity with equity. However, during the latter part of 2013 and throughout 2014, equity Crowdfunding has been explosive and confirms the trend that leads to the large projections of Crowdfunding [> $90 Billion/year by 2025]. This is the prediction from sources as Forbes and the World Bank for what will occur worldwide with all types of Crowdfunding.

Equity Crowdfunding involves a different type of interaction between a company and the individual(s) who are giving money for a specific opportunity. With Crowdfunding for rewards and cause, the “crowd” is pledging money for something they believe in as well as receiving a perk, gift or reward after they pledged their money.

A significant difference with Equity Crowdfunding is “your crowd” invests in a person or company and they want part “ownership” and a return on their investment. At the heart of the JOBS Act was the intention for allowing more individuals to invest easier than the previous rules that the SEC had in place for the last 80 years. Additionally, the investment can be made in different ways, all which imply there will be financial gain to the investor from the “issuer” (the company or person who is requesting the money). With Equity Crowdfunding, there are four major types of offers made to the potential investors.

Key Titles

Here is a brief summary of the key titles of the JOBS Act:

Contact Us

Let’s discuss how you can monopolize on these recent changes to the JOBS act to improve your business.

Equity Process

We take the time to fully understand your opportunity. We analyze key factors and shape an Assessment and Roadmap, along with other essential deliverables.